AI is taking over banking faster than you think

March 24, 2025

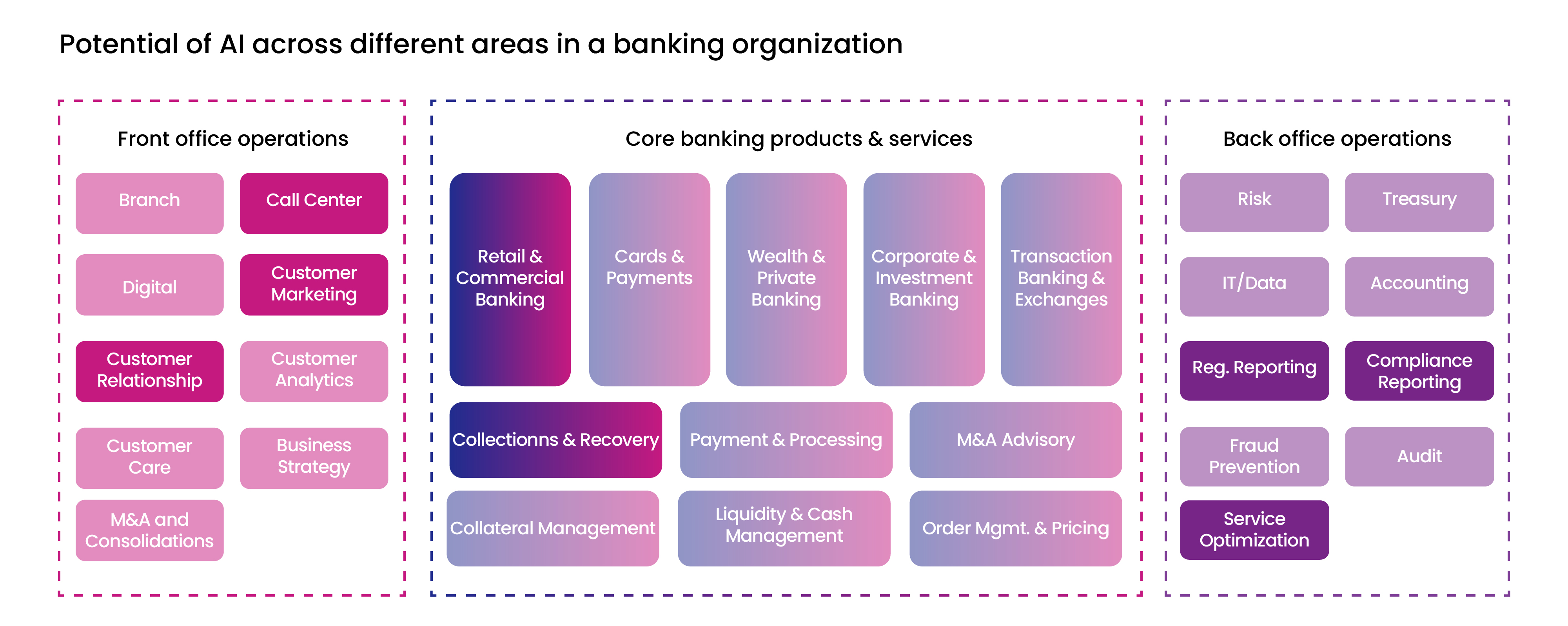

Artificial intelligence is no longer a futuristic concept—it is actively transforming industries, and banking is no exception. From enhancing operational efficiency to redefining customer engagement, AI’s role in banking continues to expand. With the advent of generative AI, banks are now leveraging advanced capabilities to drive innovation, optimize costs, and create personalized financial experiences.

According to McKinsey’s 2023 banking report, generative AI alone could enhance productivity in the banking sector by up to 5% and reduce global expenditures by as much as $300 billion. This marks a significant shift from traditional data-driven AI applications to more sophisticated, predictive, and generative capabilities that are reshaping the entire banking landscape.

The journey from automation to intelligence

AI’s journey in banking began with automation and data analytics. Early implementations focused on risk assessment, fraud detection, and operational efficiencies. However, AI has since evolved into an indispensable tool for strategic decision-making and customer-centric innovations.

Today, traditional banks and neobanks alike are harnessing AI to go beyond back-office optimizations and deliver hyper-personalized experiences to their customers. The shift towards AI-driven banking enables institutions to combine security, efficiency, and customer engagement in ways that were previously unimaginable.

Banking that understands you

Customer experience is at the core of AI’s impact in banking. AI-powered tools such as chatbots, predictive analytics, and personalized financial advisory systems are revolutionizing the way banks interact with their clients.

AI-driven chatbots, such as Bank of America’s Erica, have demonstrated remarkable success in customer service. Since its launch in 2018, Erica has handled over 1.5 billion interactions, providing real-time responses to queries, assisting with transactions, and significantly reducing wait times. These AI-driven interactions build trust and improve overall satisfaction by offering instant, 24/7 support.

Smarter fraud prevention with AI

Security and risk management remain paramount concerns for financial institutions, and AI is playing a crucial role in strengthening defenses against fraud. AI-powered fraud detection systems analyze vast amounts of transaction data in real time to identify suspicious activities and potential threats.

For instance, Barclays employs AI to monitor payment transactions and flag unusual patterns, proactively preventing fraudulent activities. This real-time, data-driven approach not only protects customers but also reinforces confidence in the bank’s security measures.

Moreover, AI-powered underwriting processes are streamlining credit assessments. Machine learning models assess borrowers’ risk profiles by analyzing diverse data sources, from financial history to social media behavior. By automating document verification and creditworthiness analysis, AI has reduced loan approval times from several days to mere hours, enhancing both efficiency and customer experience.

Personalized banking at your fingertips

AI’s ability to analyze customer data and predict financial behavior has ushered in a new era of personalized banking. By leveraging machine learning, banks can tailor products, services, and investment advice to meet individual customer needs.

Bank of America’s Glass, an AI-powered research and analytics platform, exemplifies how AI is enhancing customer engagement. By analyzing market data and user behavior, Glass predicts client needs and provides personalized investment recommendations, positioning the bank as an industry leader in AI-driven financial advisory services.

Digital banking reinvented with AI

AI is also reshaping the way customers interact with digital banking platforms. Intelligent banking apps can now adapt interfaces based on user behavior, making transactions and financial management more seamless.

For example, if a user frequently checks their investment portfolio, AI can prioritize investment-related features on the app’s dashboard. Similarly, if another user frequently transfers money internationally, AI can ensure quick access to this functionality at the optimal time. This real-time customization enhances user experience and strengthens customer loyalty.

Beyond functionality, AI is also improving the aesthetic and usability aspects of banking apps. It can personalize themes, layouts, and notifications based on user preferences whether they prefer a minimalist interface or a data-rich dashboard filled with analytics. This hyper-personalization fosters a sense of familiarity, making banking more intuitive and user-friendly.

The future of banking is AI driven

The future of banking is increasingly AI driven, blending technological advancements with customer-centric innovations. As AI continues to evolve, we can expect even greater strides in predictive analytics, risk mitigation, and personalized financial services.

While traditional banking relied heavily on legacy systems, AI is paving the way for a more agile and responsive industry. The ability to anticipate customer needs, automate complex processes, and enhance security measures positions AI as the cornerstone of modern banking strategies.

As banks and neobanks continue to embrace AI, they are not only optimizing operations but also redefining the banking experience itself. The next phase of AI in banking will likely focus on deeper personalization, smarter fraud prevention, and seamless digital interactions ensuring that banks remain competitive in an era of rapid technological change.

In this AI driven future, banks that strategically invest in AI will not only enhance their operational efficiency but also build stronger relationships with their customers. The transformation is already underway, and the financial institutions that adapt and innovate will lead the way into a new era of intelligent banking.

Quick Link

You may like

How can we help you?

Are you ready to push boundaries and explore new frontiers of innovation?