Banking

Supercharge

banking and create

digital-first experiences

Get in Touch

How can we help you?

Please fill out the form below.

Powering banking transformation at scale

Banks and FIs are facing unprecedented disruption. In the new normal, banks need to create customer-centric business models and experiences to keep up. We help Banks reimagine their businesses using the perfect combination of technology and human ingenuity to build banks of the future.

Building banks of the future

Improve every aspect of your digital journey by choosing our tailored services for your technological needs

-

Core modernization

Accelerate your bank’s success and build a rock-solid Core with our next-gen Core Modernization offeringsExplore more -

Digital Banking Transformation

Building innovative digital banks by leveraging modern technologies and digital frameworks to improve customer experience.Explore more -

Managed services

Focus on strategic business objectives and achieve operational excellence while we securely manage your technology needsExplore more -

Banking on the cloud

Unlock the potential of modern, scalable infrastructure with our modular cloud services, and step into the future of bankingEXPLORE MORE -

Consulting

Designing and executing bespoke strategies for a seamless business transformationEXPLORE MORE -

Risk & compliance

Respond to changing regulatory requirements and manage risk efficiently with our reliable risk and compliance servicesEXPLORE MORE -

Application engineering services

Reengineering business applications with speed and agility to help banks meet their strategic prioritiesEXPLORE MORE -

Data, AI, & Integration

Unlock the power of data-driven decision-making and seamless integration with our solid, end to end data management expertiseEXPLORE MORE

Meethaq Islamic Banking Elevates its Services in Collaboration with Temenos & Systems Limited

Meethaq’s transformation is a monumental leap towards redefining the landscape of Islamic banking in Oman. This strategic shift to the latest Temenos Transact Core banking release platform, orchestrated with the unwavering support of Systems Limited, marks a significant milestone in our journey and aligns perfectly with our long-term objectives. Our vision for Meethaq goes beyond traditional banking; we aspire to be the beacon of Shari'a-compliant financial services, setting industry benchmarks and fostering economic growth in Oman. We are confident that the scalability of the system will support our ambitious expansion plans, enhance our portfolio of Islamic banking offerings, and further solidify our presence in the Islamic banking landscape

Shamzani Mohammed Hussain

General Manager, Meethaq Islamic Banking Group, Bank Muscat

Oman Housing Bank Selects Systems Limited & Temenos for Core Banking Modernization on the Cloud

Modernizing our core banking capabilities with Temenos is a key part of our digital transformation project, which will enable us to strengthen our position as the largest contributor to providing adequate housing to Omani citizens. With Temenos, we’ll be able to further develop our product offering and speed up our procedures, helping us contribute even more to the economic progress and development of the country.

Moosa Al Jadidi

CEO, Oman Housing Bank

Systems Limited signs agreement to license and develop Temenos country model banks for 5 countries in APAC

Country Model Banks are a key differentiator for Temenos and working with partners like Systems Limited brings additional value to our platform, which benefits our clients and ultimately delivers incremental growth for Temenos. Systems is a trusted partner for the development and maintenance of Country Model Banks and this new agreement extends their expertise to Indonesia, Malaysia, Vietnam, Myanmar, and Brunei, helping banks in those markets with their progressive technology renovation.

Ramki Ramakrishnan

Managing Director – APAC, Temenos

Bidaya Finance has selected Temenos and Systems Limited for its digital financing transformation in KSA

Today, we mark a significant milestone in our digital transformation journey and fulfilling our mission for providing innovative and reliable financing solutions, aiming to elevate the customer experience standards and establish ourselves as one of the leaders in the digital financing realm. Together, we are paving the way for a new era of innovation and unparalleled financial solutions.

Mahmod bin Salim Dahduli

CEO, Bidaya Finance

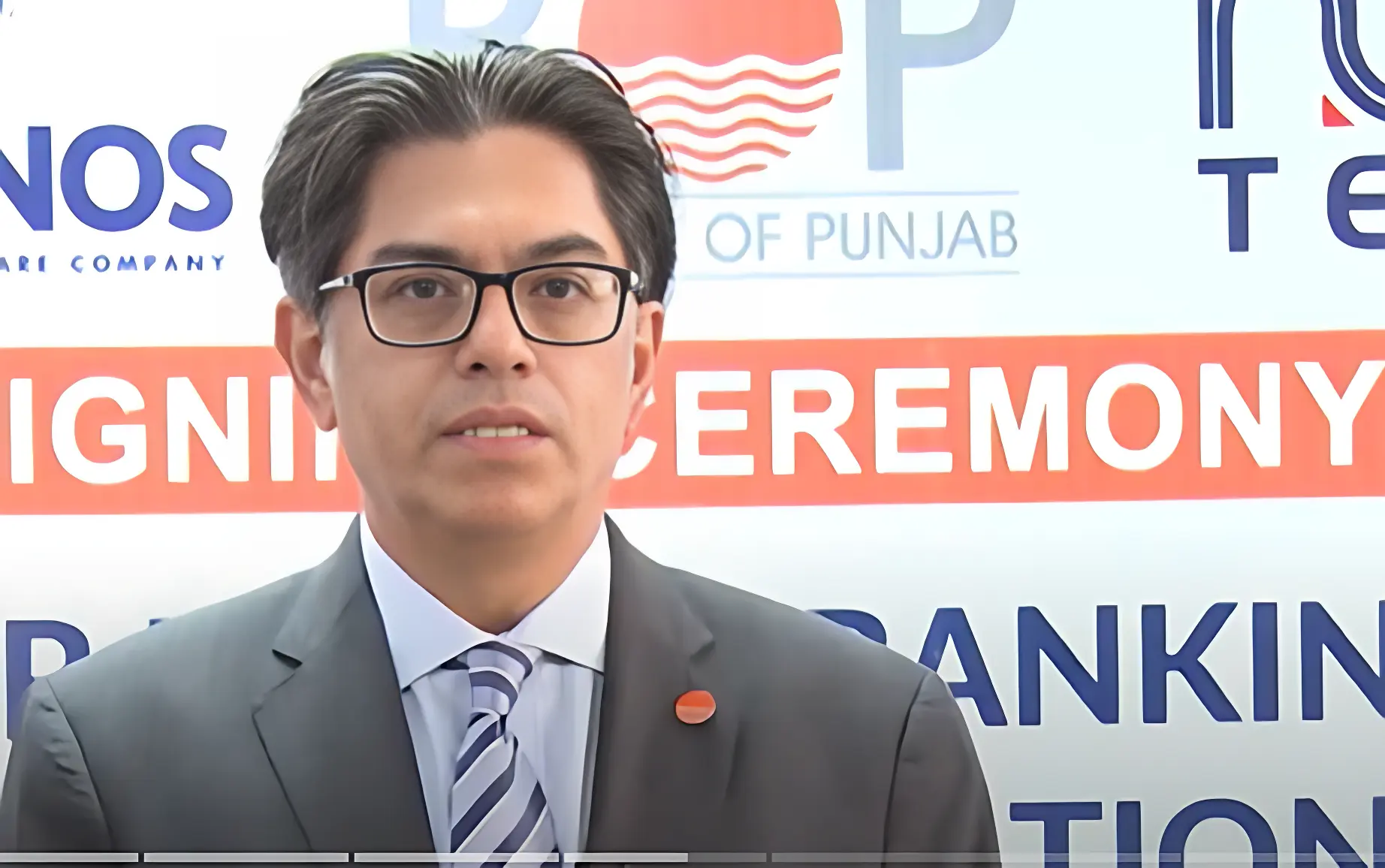

Systems Limited Partners with Mashreq for Digital Transformation

Mashreq has a history of setting the pace for innovation in the financial sector. Partnering with Systems Limited positions us to further accelerate the digital transformation of our products and services, delivering extraordinary experiences and value to our clientele in Pakistan and beyond.

Fernando Morillo

Group Head of Retail Banking at Mashreq

Bank ABC collaborates with Temenos and Systems Limited to deploy Next-Generation Core Banking System

Today, marks a momentous milestone in our journey to build our bank of the future. Consolidating our banking systems on a single platform will give us a robust foundation to accelerate growth and create significant value for our stakeholders. Temenos offers an ideal Cloud-native solution with the breadth of banking functionality needed to support all spectrums of our wholesale and retail businesses. I am confident that this next-generation core banking system will drive further operational efficiencies for the Group, enabling us to become even more responsive and adaptive to our clients’ ever-evolving needs

Sael Al Waary

Acting Group CEO, Bank ABC

Invest Bank expedites their digital transformation journey on Temenos Banking Cloud with Systems Limited

We are proud of this partnership with Temenos and NdcTech( A Systems Limited company) to transform our digital and core banking. We strive to be a pioneer when it comes to customer experience and digital services and with Temenos, the future is today. The bank's core and digital banking services will be working seamlessly together on a single platform. This will help us to foster innovation, automate workflows, as well as deliver digital experiences to meet our customers’ evolving needs faster and at a lower cost

We are pleased to announce that Samba Bank has successfully modernized its Core Banking Platform onto the latest release of Temenos Transact with NdcTech(A Systems Limited company) as the strategic partner. Working closely with NdcTech(A Systems Limited company) and Temenos over the years has enabled us to drive digital change and future proof the ongoing growth of Samba Bank. Samba Bank is now at the forefront of capability to deliver innovative and state of the art financial services to its customers and envisions to constantly innovate its processes and offerings to keep pace with the evolving digitization of banking industry.

Systems limited enables the Bank of Punjab to deliver exceptional banking experiences through Digi-BOP.

We are proud that in less than 15 months with Global pandemic restrictions, Bank went live. We have demonstrated that commitment with reliable technology partner like NdcTech (A Systems Limited Company) can overcome any challenge that comes along the way be it like COVID-19. We could not have achieved a go-live without the commitment and professionalism of Bank Management team and Technical Resources. Everyone knows that a core banking upgrade is always challenge especially in distributed environment, but we were confident of ourselves and NdcTech (A Systems Limited Company) who carried it out seamlessly.

We are delighted to have completed the successful upgrade of our Core Banking system to rebuild our technology platform & support our growth objectives. Having NdcTech as an implementation partner for Temenos Core Banking and their solid and proven expertise really helped the Bank upgrade the system on time. The upgrade ensured that disruptive new features are available to us for ongoing and future digital initiatives. This transformation has allowed the Bank to attract new customers and enhance the experience of the existing ones.

It’s a great honor that we entered into a strategic partnership with HBL for its core transformation journey. We are embarking on a tremendous journey, an opportunity for the Bank to transform itself, achieve long-term leadership, and fulfill its market objectives and innovation objectives. Together with NdcTech (A Systems Limited Company), we will support the bank in its journey over the next few years. A very promising and very exciting opportunity for Temenos and NdcTech (A Systems Limited Company) in Pakistan.

We have always remained true to our mission of transforming Pakistan into a cashless society through collaboration and technology. Our partnership with NdcTech( A Systems Limited company) to implement Temenos solutions has added a vital component to our services infrastructure, which will catapult our move towards digitization. By going live on the platform, we can now fast-track our digital transformation journey and come up with more innovative digital financial solutions for our customers in a more efficient manner.

Saudi Arabia TDF launches Digital Lending Service in 60 days with Temenos & Systems Limited

With Temenos, we have been able to build a greenfield digital service to serve our investors in record time. The first phase of the project was live within 60 days, and funding is already beginning to flow to tourism projects across the Kingdom. The Tourism Development Fund has a vital role to play in driving the growth of KSA’s tourism sector and in the diversification of our economy. Therefore, it was essential to have a technology partner that shared our vision and ambition. Temenos was the obvious choice. It is the global leader in banking technology with an agile platform and deep expertise that enables us to build rapidly and scale.

Qusai Al Fakhri

CEO, Tourism Development Fund

Customer centricity is at the heart of everything we do. This partnership with Temenos and NdcTech(A Systems Limited Company) is a great catalyst in our digital transformation journey. We are very excited to make this a part of our strategic objective of becoming more agile and tailor our platform to better serve the rapidly changing needs of our customers.

I’m extremely excited to celebrate this signing of Habib Bank Limited. We are extremely excited to be delivering full Core Banking Technology front-to-back, including our Transact Core Banking System, Infinity Digital Front Office and Analytics to Habib Bank Limited. I am excited to be working on this with NdcTech (A Systems Limited Company). NdcTech (A Systems Limited Company) has been our partner in Pakistan for the last 20 years. The quality of their team, and the level of certification they have on our solution is truly remarkable. I would like to thank them for their support and for their continuous assistance in making sure that we deliver value and customer satisfaction to not only Banks in Pakistan but also in other places globally where we do business together.

Capital Bank progresses its Digital Transformation Journey with Systems Limited and Temenos

Having NdcTech (A Systems Limited company) as an implementation partner for Temenos Core Banking and their solid and proven expertise really helped the bank upgrade the system on time. The upgrade ensured that disruptive new features are available to us for ongoing and future digital initiatives. This has allowed the bank to attract new customers and enhance the experience of the existing ones.

Hussein Abuayyash

IT Director, Capital Bank of Jordan

In order for us to continue to bring more people into the financial net, we must continue to innovate and develop products to fulfill the varying needs of our customers. With Temenos banking platform and NdcTech (A Systems Limited Company) as our technology partner we feel that we are equipping ourselves to create the financial and social impact at a rapid and competitive pace.

Indonesian Bank completes its core modernization with Systems Limited across all channels

It was a very smooth transition and we were ahead of the planned schedule. It’s the great work of 3 teams of BTPNS, NdcTech(A Systems Limited company) and Temenos. Extending my appreciation to NdcTech’s(A Systems Limited company) team for their full support in this project

Hadi Wibowo

CEO, BTPN Syariah

The Bank of Punjab envisions to design a unique “Banking” experience for this new Digital World. Digital Transformation is a key pillar in achieving our goal of being among the top five commercial banks of Pakistan. Our ambition is to be a progressive and digital-first bank in the next few years and build digital products and services centered around our customers’ needs, available to them at their fingertips, all the time and everywhere. The Bank of Punjab aspires to be at the forefront of digital innovation and contribute significantly to the national financial inclusion drive. With the growth in digital banking adoption and new systems in place, The Bank of Punjab will make sure to keep a strong focus on digital security and governance to protect its customers’ interests and information.

We are happy to sign up with NdcTech (A Systems Limited Company) for the Temenos Digital Banking platform. This is an important step towards our digital transformation. We believe this commitment with our long-term partner NdcTech (A Systems Limited Company) will provide the leap forward and put Khushhali Bank at the cutting edge of technology to deliver better services and products through multiple channels.

Amlak International adopts the latest Digital Lending Systems in partnership with Temenos and Systems Limited

This step is part of Amlak’s global strategy to adopt leading best practices and professional standards to stimulate its position within the real estate finance sector. These procedures and operations will enhance the company’s ability to meet its customer’s needs.” Al-Sudairi pointed out that Temenos’ choice of operational solutions reflects Amlak’s commitment to cooperate with the best banking and financial system providers to ensure the delivery of high-quality products and solutions in line with Amlak’s global philosophy.

We are proud that in less than 15 months with Global pandemic restrictions, Bank went live. We have demonstrated that commitment with reliable technology partner like NdcTech( A Systems Limited company) can overcome any challenge that comes along the way be it like COVID-19. We could not have achieved a go-live without the commitment and professionalism of Bank Management team and Technical Resources. Everyone knows that a core banking upgrade is always challenge especially in distributed environment, but we were confident of ourselves and NdcTech ( A Systems Limited company) who carried it out seamlessly.

We are at the forefront of delivering mission-critical IT services to pioneering Banks and Financial institutions globally.

1000

Global banking clients

23

Certified consultants and engineers on banking technology

30

Years of experience in transforming banks

125

Million customers bank on the systems implemented by us

Our strong ecosystem of partners

Systems Limited signs agreement to license and develop Temenos country model banks for 5 countries in APAC

Systems Limited partners with Formpipe to drive digital innovation Banks in MEA and KSA

Systems Limited win Best Core Banking implementation award by IBS Intelligence

Newsroom

NEWSROOM

Meethaq Islamic Banking Elevates it's Services in Collaboration with Temenos & Systems Limited

NEWSROOM

Bidaya Finance has selected Temenos and Systems Limited for its digital financing transformation in KSA

NEWSROOM

Oman Housing Bank Selects Systems Limited & Temenos for Core Banking Modernization on the Cloud

How can we help you?

Are you ready to push boundaries and explore new frontiers of innovation?