What’s driving the new age of core banking modernization?

January 05, 2023

Banking has become a crucial aspect of our modern economy with banking-as-a-service hitting mainstream adoption in the next two years. Traditionally operating as brick-and-mortar institutions, banking has changed with the advent of technology and how consumers see banking services.

As the banking industry continues to evolve, it's imperative for financial institutions to keep up with cutting-edge technologies surfacing the market. One way to keep up with the fierce competition is by modernizing your bank's infrastructure, which requires upgrading your core banking system architecture, adopting new tools and processes, and implementing new ways and means to uplift your existing infrastructure.

Many believe modernizing a bank's infrastructure isn't a simple task. It requires considerate planning, a clear understanding of your needs and goals, and a willingness to adapt and change. In this blog, we'll provide a comprehensive guide to upgrading your bank's core infrastructure, including key considerations and best practices for a successful way forward in 2023.

Why is it important to modernize your bank's infrastructure?

Let's first define what we mean by "infrastructure." In the context of banking, infrastructure refers to the underlying systems, technologies, and processes that support the operation of a financial institution. This can include everything from your core banking system and payment processing solutions to your IT infrastructure and security protocols.

Also read: Exploring the untapped potential of banking in the metaverse

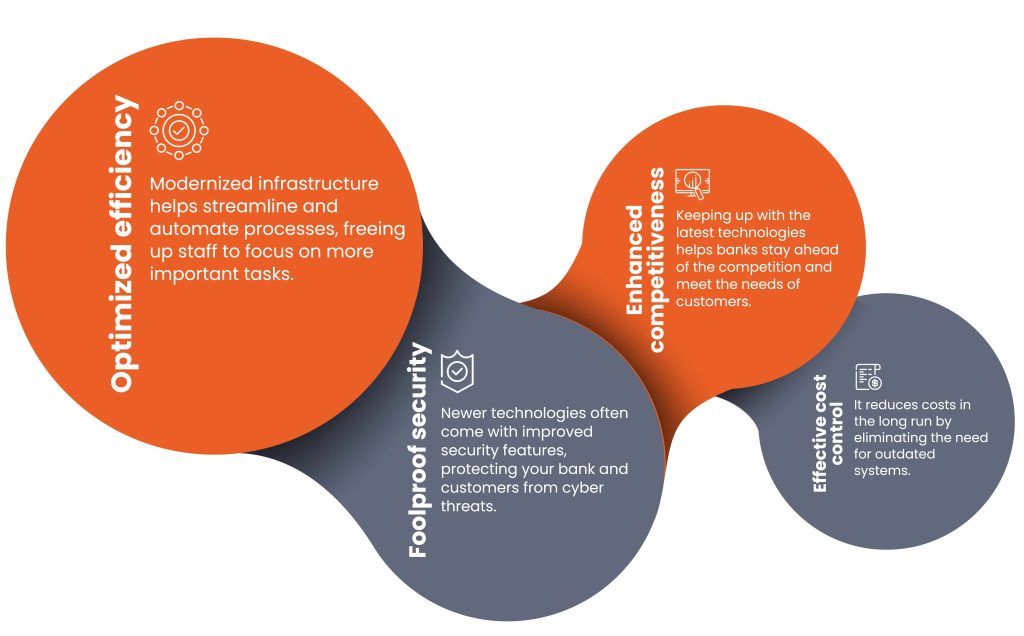

Experts at Gartner believe that 20% of the data banks generate for their customer-facing use cases will be artificially produced by AI, cloud computing, and similar cutting-edge tech by 2025. While thriving in today’s world of digital disruption is hard, what financial institutions can do to stay competitive in the dynamic business environment is to enable and experience the multi-faceted verticals of core banking transformation. Here are four ways why modernizing your core banking procedures has become essential.

4 Gains you get a core banking degradation

What should your core banking transformation journey look like?

Core banking modernization is purpose-built to replace the old legacy systems and bring in agile and receptive ones. You should consider this because once the upgraded banking solution is in action, it creates a greater potential for improved customer experiences, enhanced competitiveness, and effortless regulatory compliance.

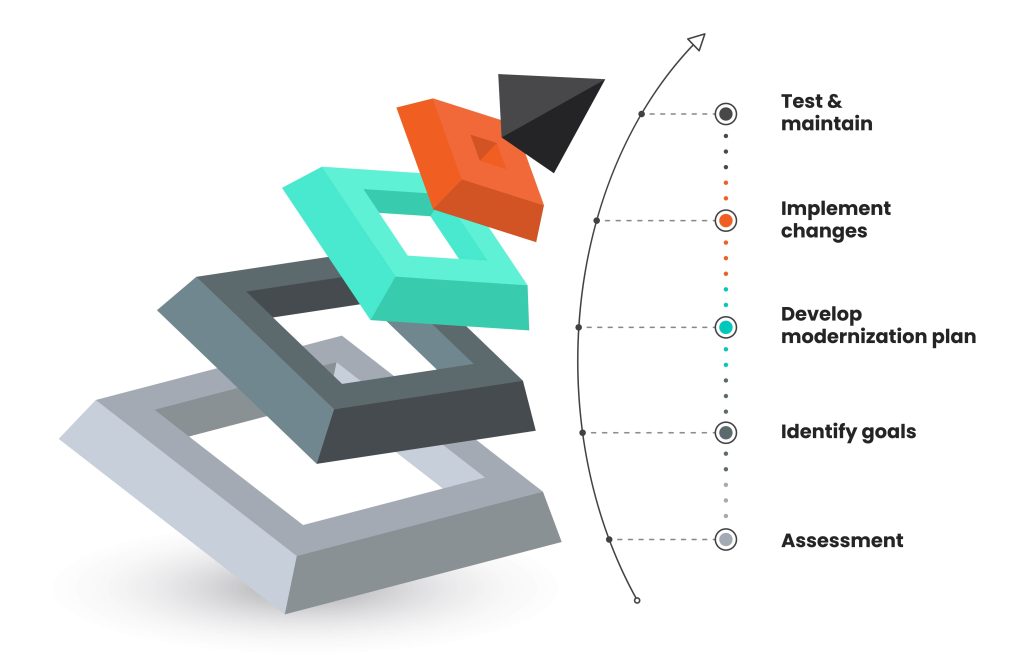

We explain the key steps in the core banking modernization process and why they are important to build a modern-day banking infrastructure that is resilient, competitive, and nimble.

Core banking modernization journey

Step #1 - Assess your current infrastructure

Before you begin any upgrades, it's important to have a clear understanding of your current systems and processes. Start by identifying the areas of your bank's infrastructure that are in need of modernization.

This includes evaluating your core banking system, IT infrastructure, and security protocols along with legacy systems and processes that are inefficient and prone to errors, or technology that is no longer supported.

Step #2 - Identify your needs and goals

Once you've assessed your current infrastructure, it's time to identify your specific needs and goals. This may include things like improving efficiency, enhancing security, increasing competitiveness, or reducing costs. Identifying this will help you create a tactical plan to begin and manoeuvre your core banking modernization journey.

Step #3 - Develop a modernization plan

After identifying the areas that need improvement, develop a core banking modernization plan that outlines the steps you will take to modernize your bank's infrastructure. This should include details on the systems and processes you will update, the timeline for implementation, any critical banking resources that need enhancements, and detailed steps for each upgrade.

Step #4 - Implement the upgrades

Once your plan is in place and all set for execution, it's time to begin implementing the upgrades. This may involve upgrading your core banking system, adopting new technologies or processes, or making changes to your existing IT infrastructure.

Put your modernization plan into action by implementing the updates and improvements you have identified. You can start by deploying new technology, making your employees acquainted with the new software, and fine-tuning your policies and procedures based on the way forward you decided earlier.

Step #5 - Test and maintenance

After the upgrades have been implemented, it's important to thoroughly test the new systems and processes to ensure they are working as expected. Regular monitoring is also critical to ensure that the upgrades continue to meet your needs and goals.

Once the modernization process is complete, monitor and evaluate how effective the changes are in the long run. This will help you identify any areas that may still need improvement in your core banking infrastructure and allow you to make necessary improvisations.

From traditional to modern: Transforming the future of banking

Upgrading your bank's infrastructure is a complex process, but it can bring numerous benefits to your financial systems and your customers. However, it requires a competitive modernization plan and execution to ensure a smooth transition to agile and effective systems. Start with a comprehensive assessment of your existing systems, create a solid execution plan built on industry standards, and just put it into action.

What’ll happen next is you’ll start to experience change from the grassroots level spanning to the whole organization, preparing you for the core banking transformation you deserve.

Being a Temenos partner organization, we bring accelerator tools and assets to our banking customers with a proven track record of exceptional execution and delivery. Get in touch with our experts now!

Quick Link

You may like

Designing GCCs for the Known Unknowns

Banks face evolving rules, customers, and technology.

READ MORE