How future-ready enterprises leverage digital finance transformation

July 06, 2022

41% of business leaders believe that increasing their revenue and taking out costs is their number one priority. Regardless of your operating industry, this fact remains universal that digital transformation is today’s ultimate game-changer.

Suppose you’re the Chief Financial Officer (CFO) at an enterprise or a bank. What’s the first thing you will suggest for digital transformation of the quality and structure of financial services at your company?

An agile operational model? A data-driven infrastructure? Maybe both.

But the fact remains that you need to redefine the meaning of finance and establish its role as a business partner to turn retrenchment into growth.

While 90% of finance professionals stress that business operations need to align with their company’s financial strategy, organizations must adopt financial processes as per their rapidly emerging business models.

Let’s look further into how digital finance transformation can support your enterprise structure, optimize costs, and automate core financials in today’s age of high market volatility.

What is digital finance transformation?

A digital finance transformation strategy integrates tools, technologies, and strategies to empower finance experts. This empowers them to manage, innovate, and optimize financial strategies, ultimately enhancing the overall organizational infrastructure. It facilitates operational agility and digital finance adoption through automation, providing comprehensive digital transformation solutions.

Digital Finance transformation in action

Digital transformation is a ‘popular’ necessity in most industries, and finance is no exception. But how is this popularity driving the digital makeover? What future of finance transformation trends are driving banking, FinTech, insurance, and other relevant industries?

We’ve answered these questions below to make your life easy, compiling the top three ways digital technologies are shaping the future of finance in 2024.

Robotic Process Automation (RPA)

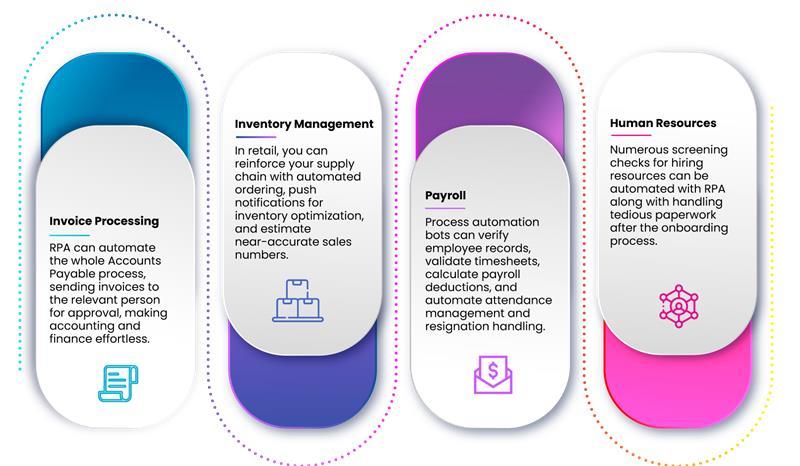

RPA is the use of automated software tools and robots to perform repetitive tasks without the need for human intervention. RPA plays its role in finance transformation by helping out with automating payment processes, extracting data from expense reports, and creating financial documents that your company will use to carry out critical operations. This adds value to your organization since you are now focusing on essential tasks rather than the mundane ones.

Also Read: Automation through bots – Process optimization through RPA

Here are some use cases of how robotic process automation is bringing innovation.

Data visualization

Digital finance transformation is all about how you change the way your organization delivers value to customers. Businesses no longer prefer legacy architectures; but rather cloud-based frameworks With digital tools in place, you can have real-time access to all the data you need from a data lake, a repository where all your data is stored in its purest form. Rather than guessing what to do for your customers, you are now focusing on maximizing value for them by enabling effective information flow within the organization.

Informed decision-making

Your financial strategy will only be as effective as the data which supports it. Since digital finance transformation initiatives are about creating bridges and burning barriers, you need to rely on trendy technologies like artificial intelligence and data mining. They help you identify innovation gaps, effortlessly manage your expenses, and forecast business changes based on numbers for the future of finance.

Digital finance transformation strategy holds the future

Top financial leaders agree that speed and flexibility in managing financial expenses help their company progress better. That said, there is mounting pressure on organizations to constantly co-innovate their digital financial practices and create synergy between their teams and the technology they use.

Digital finance transformation systems can work effectively for your organization if you pair them with the right process and strategy as a whole. In 2022 and beyond, finance transformation will depend on the right mix of digital financial technology and companies adopting a growth mindset on a wider scale.

Make financial procedures at your organization look like a breeze with end-to-end enterprise integration, data-driven analytics, and robotic process automation. Connect with our technical experts today!